Shift4’s Acquisition of Global Blue (GB)

Another One

Shift4 (FOUR) announced the acquisition of Global Blue (NYSE:GB) in February 2025. I’m probably late with my review for many readers, but given the deal’s size/significance at +20% of the market capitalization, there’s probably still some interest.

A Brief Global Blue Overview

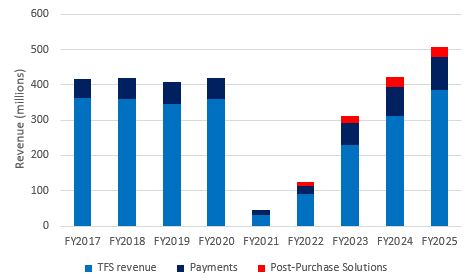

Global Blue (GB) is the global leader in VAT tax refunds. They also offer payments, FX solutions, retail technology, post-purchase solutions, and a CRM system for merchants’ marketing activities. GB dominates the Tax-Free Shopping (TFS) vertical with an estimated >70% market share and is 3x the size of its next competitor. Figure AA shows historical revenues for all GB segments.

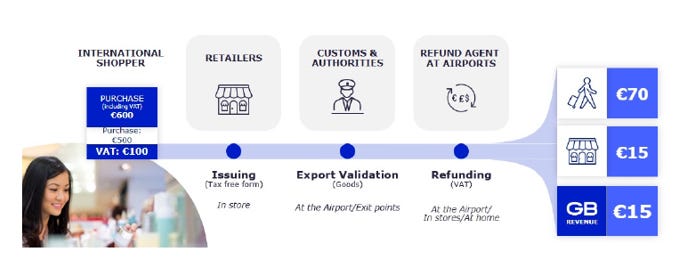

Starting with the biggest segment, Tax-Free Shopping Segment (TFS), which helps international shoppers obtain VAT refunds paid outside their home country. The TFS segmented generated 76% of total revenues in FY25. Figure AB shows how this works for a customer. A shopper purchases shoes for €500 at a store and pays a VAT of €100, totaling €600. At the point of sale, retailers issue a Tax-Free Form, which the customer takes to the Customs authority for authorization. This authorized form is processed by a GB Refund Agent at an airport. At the end of the day the shopper gets a €70 refund, with the remaining VAT refund split between the retailer and GB. Splitting the economics with a retailer and GB creates a strong incentive for retailers to ensure the GB service is offered on relevant transactions. Lastly, looked at it another way GB captures €15 on a gross purchase of €600, roughly 2.5% of the transaction value.

If you’re wondering if paper receipts are still used today, the answer is largely no. GB has digitized this experience for customers. Customers used to take a physical receipt to an agent, then wait for a cash, cheque, or card refund. This has been automated using software at all key stages including Issuing, Export Validation, and Refunding. GB has used the pandemic to accelerate the rollout of its digital offering. This process is now completed through a self-service kiosk or phone app. As of today, digital issuing is effectively 100%. The incremental areas of improvement through technology investments are with eligibility detection (ED) coverage ratio improving about 30% from pre-pandemic levels – allowing effective identification from the Card BIN to prompt the retail worker for a VAT Refund Form. The second major improvement is secure card capture, allowing merchants to use the same card for a refund after purchase validation. Figure AC shows trends on eligibility coverage detection ratio (%) and secured card capture as a % of Sales in Store (SiS).

Incremental progress on other TFS process parts is evident. The export validation component has been transformed with a streamlined process for TFS shoppers. Customers are now provided with transparent updates on their VAT refund status. Lastly, the company’s digital refunding process, after export validation, frees up time for GB and retail representatives - this allows them to spend more time with customers - a clear positive. Figure AD shows metrics for these KPIs.

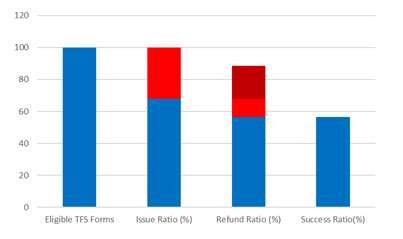

All these components feed into two areas: the number of VAT Tax fund forms issued and the number of VAT Tax refunds completed. Multiply these figures for the “Success Ratio”. Figure AE shows out of a theoretical 100 forms, only 68% were issued and from that subset 83% were refunded. This converts into a “Success Ratio of 56% - up 4-6% points vs FY22/23 and FY19/20 largely driven by to improvements in the Issue Ratio. Compared to its largest competitor Planet, it has seen better recovery in France, Spain and Italy by 47-58% (FY23/24). These digital improvements are helping its Issue and Refund ratios over time and partly explain their market share gain in geographies like Spain, where it is up ~10% to 77% since 2019.

The Payments segment is the next largest revenue contributor, representing 18% of total revenues in FY25. This includes GB’s acquiring capabilities, dynamic currency conversion (DCC) at POS/ATMs, and multi-currency gateway for Hotels and Luxury retailers. This allows Merchant partners to let international shoppers pay in their home currency at the point of sale. GB can also offer this solution for e-commerce or ATMs, where shoppers see totals in foreign or local currencies. GB can generate revenues from FX spreads (high margin) and per transaction fees. In the DCC process, revenues are split between acquirers, merchants, and GB - in this example, GB captures 1% of the gross purchase value. Notably, this would in addition to the 2.5% illustrative fee from the VAT refund process.

The next segment, representing ~6% of revenues, is Post-Purchase Solutions (PPS). From 2020 to 2024, they completed 3 acquisitions to solve further pain points for consumers and travel merchants. ZigZag was purchased in 2021, addressed the complex issue of returns for TFS purchases, enabling merchants to add exchange and refund capabilities. ZigZag had a network of over 1,000 carriers and >200 warehouses to group shipments and reduce logistics costs – i.e. send all returns to Paris in one shipment. From GB’s perspective, this gives them another solution to sell to the merchant base and allows them to capture revenue on the subsequent return or exchange.

The second acquisition was of Yocuda, partially acquired in 2021, adding digital receipt and CRM capabilities for subsequent promotions. Yocuda’s identifying capabilities enhance merchants’ targeting, especially so if it were to be combined with ZigZag data. Yocuda merchants on the website skew away from luxury goods, including Marks & Spencer, Decathlon, and Sephora, but it’s unclear if this is important- the value proposition should still make sense. ShipUp was the last acquisition, providing merchants order status updates and real-time tracking. These bolt-on deals are additive to GB’s data moat, remove pain points for merchants and consumers, and capture post-purchase revenues (which may be less cyclical).

Competitive Advantage

GB is the leading specialty payments platform for Tax-Free Shopping with a +70% market share. GB’s competitive advantage comes from switching costs, intangible assets, and modest network effects.

Switching costs for merchant partners are high – most luxury goods retailers aren’t frequently switching retail POS platforms nor doing it in specialized verticals like TFS where competition is limited. Clients sign multi-year contracts with GB and a few competitors cited this as the biggest barrier to entry. The other contributor to stickiness is that GB individually negotiates the VAT refund split with each retailer – LVMH or Chanel might get over 50%, and this payout is a source of high margin revenues. New entrants would not only need to have a superior platform and incremental incentives to meet/beat GB’s payouts.

The next driver is that GB has invested more in intangible assets like R&D, technology, and know-how to operate with each regulatory authority. GB’s kiosks and applications offer fast refunds and clean user interfaces, creating a positive experience for shoppers. The front end is visible to shoppers, but the back end is equally important – GB’s digitization efforts translate into a superior cost structure. I mention this before considering the recent buildup of post-purchase solutions which are still penetrating their merchant base and will create further stickiness with GB’s platform.

The last major factor driving their competitive position is network effects. As the largest player in the TFS market, they generate substantially more data which can be used to promote products and drive cross-sales (e.g. Hotels or Sports & Entertainment). GB collects around 50 data points per transaction, including the purchaser’s passport information, SKU specifics, and the transaction details. After collecting this data, much like other ad-tech businesses it is enriched to identify and profile shoppers. GB is the authority on international travel luxury spending and enables ~1/3rd of category spending. If Chanel wants to determine its Abu Dhabi store’s performance, GB can show how it performs vs peers, its tourist mix as % of sales mix, basket size, and refund speed. Brands can’t replicate this information with insight into only their assets. It isn’t a surprise that GB’s net retention ratio (%) is consistently >100% as shown in Figure AG.

Vertical / Market Assessment

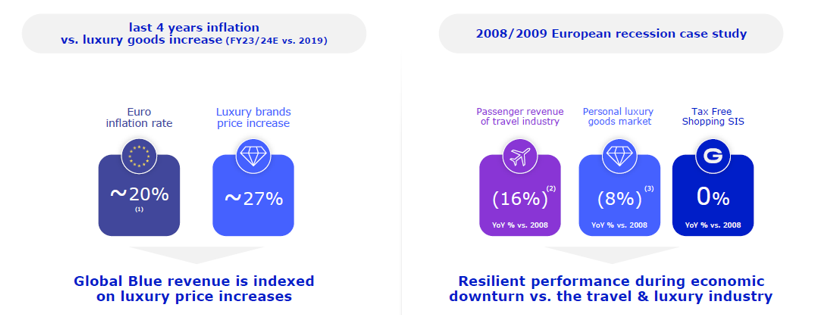

GB sits at the intersection of the Travel and Luxury Goods markets, both historically growing at GDP+ levels. Benefits include exposure to luxury price increases and reduced exposure to economic downturns. Figure AH shows a slide from GB’s FY23/24 presentation.

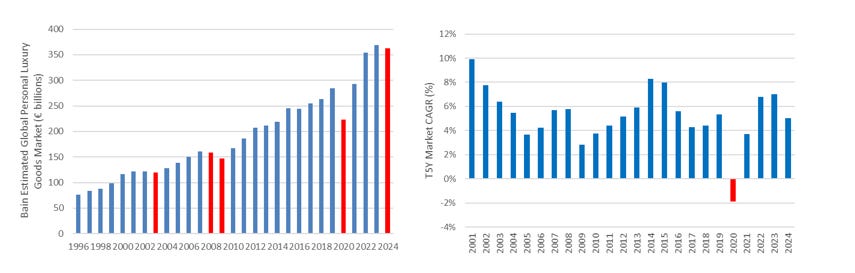

Figure AI below shows that from 1996 to 2024, the Global Personal Luxury Goods market sales grew at a 5.7% CAGR. In only 5 of the past 29 years did sales decline year-over-year, with the worst year in 2020 during COVID-19. Downturns were short, with sales recovering to prior highs in less than 2 years. From another perspective, rolling 5-year market CAGRs were positive in all but 1 period, growing at a minimum of a 2.7% CAGR. Expectations are for this market to grow >5% over the next decade according to Bain. GB has tailwinds from total market growth and pricing power of luxury brands.

GB’s exposure clearly skews towards luxury purchases. In FY2025, GB generated 41m transactions with an average value of €587. These are impressive figures relative to the pre-pandemic count of 35.2m, and especially given the UK eliminated VAT refunds in 2020/21 – which accounted for ~13-15% of transactions. Rumors suggest the UK may reverse this change, but I don’t know the probabilities. Offsetting this could be the recent addition of VAT Tax Refunds in Saudi Arabia and nine other countries which are at various stages of adopting VAT refunds policies to effectively stimulate tourism. I see more reasons why the market seems likely to grow than shrink - GB’s expectations are similar expecting a 1.5-2% tailwind from new markets over the long-term. Figure AJ below shows GB’s results from FY09-19 and Long-Term growth targets from its FY24 presentation.

So GB is a leader in an attractive market. What if a new entrant tried to enter? Many previous attempts to enter this market have failed. Uri Levine, Waze’s former founder, created Refundit to grow in this market. His business struggled, leading him to file a lawsuit with the EU competition unit in Brussels in 2021. An FT article said:

“Global Blue built the business in a way that’s good for them. It approached high-end retailers and signed long-term exclusivity agreements for the long term. The company is charging tourists huge fees that are unknown for the traveller,” Levine added. “People are happy to get some money back but not knowing that money has disappeared in a very [opaque] way.” In its complaint, Refundit said it wants the EU to impose a transparency obligation over the commission Global Blue charges travellers. Refundit also wants regulators in Brussels to prohibit Global Blue from sharing commission with merchants.”

The quote shows why FOUR may have admired the business: 1) They have secured long-term agreements with luxury retailers with strong pricing power 2) limited transparency on fees – and 3) its incentive sharing approach with merchants makes it harder to dislodge as switching to an alternative would lead to an immediate loss of one source of revenue. The EU commission closed the preliminary probe in July 2023 with no fines or remedies. The list of upstarts that have attempted to dislodge GB is longer, but this was the best example to illustrate its competitive position.

Merits of Deal

Global Blue fits well into Shift4’s historical acquisition framework – it adds a hospitality gateway, relationships with many merchants not using an E2E solution, and expands their presence internationally. It adds industry-specific talent and know-how in the TFS market. The Dynamic Currency Conversion and Multi-Currency Payment are incremental capabilities and can be rolled out over time to the rest of the FOUR merchant base. GB also had a growing presence in Australia for acquiring. Pro-forma this will allow them to process payments in 75+ countries as shown below in Figure AK, compared to starting from just the USA at IPO.

The company is offering $7.50 per share in cash, or a $2.5b total purchase price. The price offered to GB shareholders was only a ~15% premium to the prior week’s price, translating into ~13.3x TTM EV/EBITDA multiple. On forward estimates (only 1 broker), a 5x P/sales or 25x F/PE on an estimated $90m net income for 2025. FOUR guided to $80m in revenue synergies and $70m in EBITDA drop through.

Breaking down GB’s customer base reveals potential underwriting synergies. Sales in Store (SiS) were split 78/22 with Global Accounts (59%) and Department Stores (19%) as the largest, followed by Accounts/Key Accounts at 11% each. These merchants contribute to the estimated $500b payments potential Shift4 could capture. Enterprise-like customers (Global Accounts + Department Stores) will be the hardest to win over, as they skew towards Adyen or Stripe. However, some customers have a split between a partner in developed and emerging markets – where FOUR’s incremental broader geographic coverage could increase odds of winning an E2E customer. The smaller accounts, accounting for 22% of sales, are more likely to convert to FOUR’s E2E solution. The $80m revenue synergies assume 10% of accounts will shift over, and 2% of enterprise-like accounts. The dynamic currency conversion and multi-currency payment gateway also have huge monetization potential across the FOUR customer base - Hotels and Sports & Entertainment Venues all seem like a great fit for this technology.

FOUR expects $80m in run-rate revenue synergies and a $70m run-rate EBITDA contribution by 2027, but that’s without “deleting the parts” and removing redundancies on the GB cost base. With just incorporation of the $70m EBITDA contribution we get to $272m in EBITDA or a synergized multiple of 9.2x - pretty good.

However, fixed operating costs were $193m, $173m and $154m over the last few years. I don’t expect FOUR to be complacent on costs here but the magnitude of potential improvement here seems up for debate - If FOUR can remove 20% of the cost base over time, the synergized deal multiple would be ~8x. That’s a bit higher than other deals, but given the size and upgrade from a vertical perspective (more pricing power exposed) it looks like a great deal. Figure AL provides an illustration of this.

Concluding Thoughts

I believe FOUR has reset its approach to setting guidance as Jared was expected to transition out of the CEO role. The new guide for +25-30% EBITDA CAGR depending on deal pace looks attractive. If FOUR can deliver on the $1b FCF Target by 2027, I believe returns will be strong.

Recent news about Jared’s NASA appointment suggests he won’t take that role, but it’s unclear if he’ll return to the CEO seat. I don’t know if it matters at this point what his specific role at FOUR is. He owns a lot of stock and will scrutinize what Taylor and the team are doing. The business has a good runway for growth and the team continues to impress with capital allocation.

I continue to own shares in FOUR.

Let me know if you have questions or feedback on this post – reach me on X at @icemancapital or icemancapital@gmail.com