Shift4 Q3 2025 Results

Stepping on the Gas

Shift4 Payments Q3 2025 results were largely in line with expectations. Total Net Revenues were up 61% YoY (including Global Blue), and Gross Profits (non-GAAP) increased 62% YoY. End-to-End volumes grew 26% YoY to $55b, slightly higher than consensus. Adjusted EBITDA rose 56% YoY to $292m (49.6% margin, down 170 bps YoY). Unit economics were effectively flat, with net spreads at 62 bps. GRLNF was up 19% YoY, or 61% YoY (including Global Blue). Exhibit AA below provides a snapshot of results vs consensus and the prior year.

For FY2025, the company narrowed but reaffirmed guidance, including volume of $207-$210B (26-27% YoY growth), gross revenue less network fees of $1.98-$2.02B (46-49% YoY growth), adjusted EBITDA of $970-$985M (43-45% YoY growth), and adjusted FCF conversion of >50% (implying ~$496m in FCF this year). Management also reiterated their comfort with the 3-year “most-likely” growth targets of >30% CAGR into 2027 as shown in Exhibit AB.

Shift4 also provided a headline figure of +18% organic growth for the first time this quarter, but the key components contributing to this line item were not disclosed (e.g., same-store sales growth, net new customer wins, and conversion of acquired customers). It’s also unclear if this would include merchant-only revenues or just the uplift generated from a conversion from gateway-only to E2E. And, while it is nice to see the incremental disclosure it does appear to be below the 2025 target of ~20% organic growth for the business . All said, happy to have another data point to monitor over time.

Corporate Actions

FOUR also divested multiple small non-core assets with the largest being of acardo to Verve Group SE for proceeds of $34m. Acardo was a couponing business working largely in Germany, working with ~5,600 retail stores and branded retailer applications. This contributed to modest deleveraging in the quarter.

On the acquisition from, they acquired Worldline North America also known as Bambora. This gateway has $90b of volumes, adds one of the largest ACH/EFT providers in NA and adds 100s of software integrations. FOUR’s biggest homerun deals have been gateway acquisitions, and my understand is that this gateway skews heavily to Canadian Restaurants it seems like a great fit. Compared to the GB deal this is tried/tested playbook which should make the risk profile very low. FOUR is paying 70m EUR for the asset, an ~8.7x EV/EBITDA multiple. This adds to the cross sell funnel an attractive pipeline of ~140,000 merchants who can be converted to full E2E solution over time. The deal implies a cost of acquiring a customers at ~$580 - pretty good.

FOUR is ahead of schedule on debt repayment; they were targeting 3.3x Net Leverage by the end of 2025 but achieved 3.2x this quarter.

Global Blue

Global Blue Sales in Store (SiS) was +5% YoY driven by Europe +13% and NA offset by weaker results in Asia, where the business lapped tough comparable driven by a record low Yen last year down 11%. Exhibit AC shows trends on year over year basis. More recently though, trends in Asia recovered to be roughly flat during the month of September. Total revenues were $170m, or $156m after network fees. EBITDA contribution of $68m, and margins of ~43%.

Operationally, the business continues to track towards prior targets. A new 3 in 1 POS terminal with Payments, Currency Conversion and VAT Refund capabilities is in Beta Testing. What they called a “don’t screw things up acquisition” seems to be going ok outside of some macro noise.

SkyTab International Expansion

In the past, Shift4 has faced bigger-than-expected challenges in driving international growth. Localization complexity related to tax fiscalization, language support, and consumer behaviors led to a “multi-year” ramp in Germany, France, and Italy. This is in contrast to the UK market which required very little investment and as a result was one of the first markets they were able to launch in.

As the data points below suggest some momentum is building in the last 18 months. There’s a growing likelihood they will meet their target of 45,000 international locations by year-end.

Q3 2025 “Adding 1,300 international restaurant and SMB wins per month”

Q2 2025 “FOUR is installing SkyTab at a pace of ~3,000/quarter as of 2Q25”

Q1 2025 “signing up over 1,000 restaurants a month internationally”

Q4 2024 “hundreds of international restaurants across Canada, the United Kingdom, Ireland, and Central Europe, with the broad launch to Vectron’s 300-plus European dealer network yielding “hundreds of deals already signed up in January”

Quotes from the Earnings Call

Positives

“I wouldn’t be able to discuss capital allocation without the notable dislocation in our own valuation despite the continued performance of numerous opportunities we see ahead. In short, our own equity is one of the more attractive opportunities we see, and with expanding cash flows and accelerated deleveraging, we simply can’t ignore it. To that end, our Board has authorized the new $1 billion stock repurchase program, which is the largest in our history. We will be implementing a plan to purchase of what we view as highly attractive levels right away.” - Taylor Lauber (CEO)

“As you get to know me more, it should come as no surprise that I believe that the ultimate measure of business durability is compounding growth in free cash flow per share. So I’m particularly enthused by the progress of this metric, especially as a jumping-off point towards our medium-term guidance goal of exiting 2027 with $1 billion of run-rate adjusted free-cash flow.” - Christopher Cruz (New CFO)

Lastly, we agreed to acquire Bamborra, otherwise known as World Line North America. While I’m sure many of you would like to see a slowdown, the opportunity presented by a $90 billion payment gateway was something we would not ignore. A core competency of our business and team is to constantly seek out interesting technologies, great customers, and excellent talent. Those of you who know our track record of executing on gateway conversions and other synergies can appreciate why this makes so much sense. We expect that transaction to close in Q1 of ‘26 and are encouraged by our pipeline of opportunities. - Thomas McCrohan EVP, Strategy & Investor Relations

Negatives

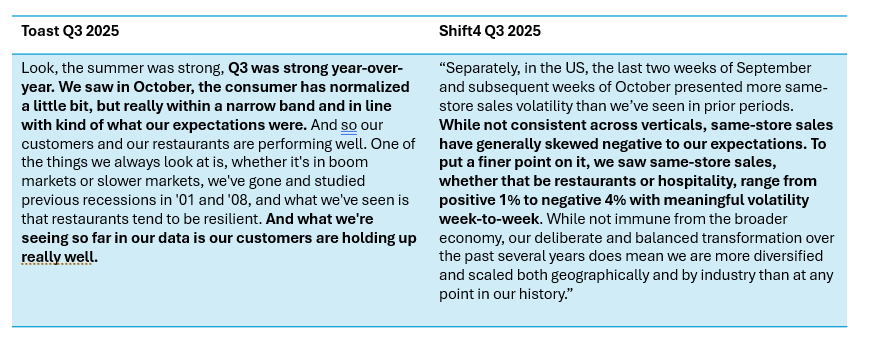

Compared to TOST management’s Q3 2025 tone on SSS volatility, FOUR’s seemed more negative (at least relatively) as show below in Exhibit AD. If you are more skeptical about FOUR, you might interpret this as them having more discretionary exposure than Toast, but I’m not convinced it’s materially different.

Investors were focused on FY26 guidance, which implied about $240b in E2E volume, up about 13% YoY. This was light compared to the current consensus of $255b, implying +22% growth. Backlog of $35b has been stable since last quarter; while growth would have been nice, there is potential for growth in the future as they integrate Global Blue, Bambora, and SmartPay, and begin to drive cross-sell.

Lastly, Jared was renominated by the Trump Administration to run NASA. He is not required to sell any of his shares, and all indications from earlier this year is he is involved on capital allocation and strategy work. As disclosed in the ethics agreement earlier this year he will relinquish/convert the Super Voting B shares into common shares. This should clean up the perception of the corporate structure and may elicit interest from a wider range of investors.

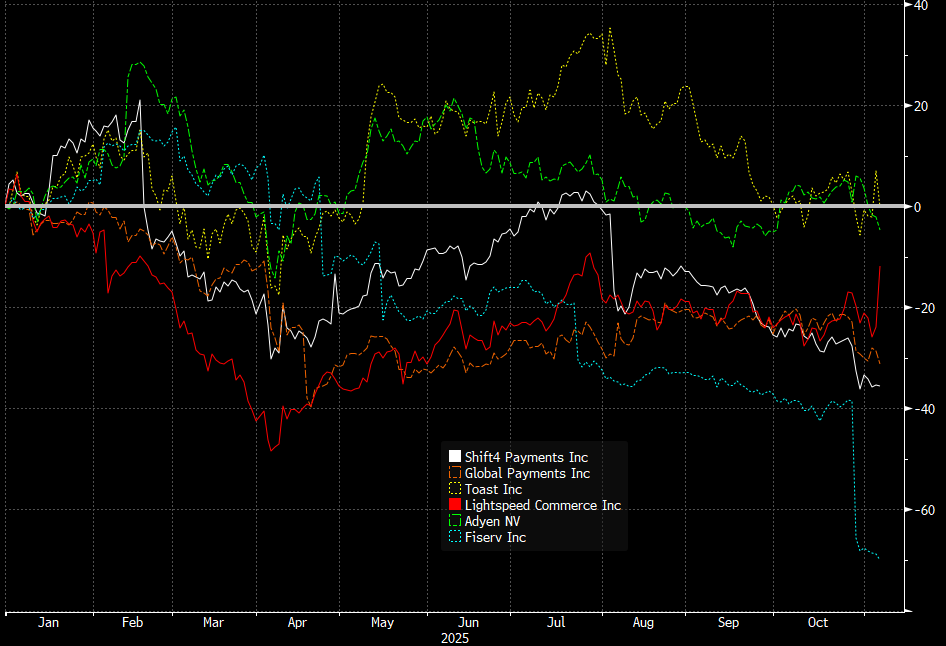

Management clearly believes shares are undervalued and is taking action to capitalize on the opportunity with a $1B share repurchase program. They recognize that FCF per share is the north star, and this program alone could lead to the repurchase of approximately 15% of the current market cap. FOUR continues to make progress toward its medium-term financial targets and remains aggressive with M&A. At ~8x EV/EBITDA, I don’t believe I’m paying for growth or optionality from M&A. I remain positive on FOUR, but it has been a painful ride year-to-date.